Portfolio: Valuation Office Agency (VOA)

Council Tax notice of alteration

Overview

Project

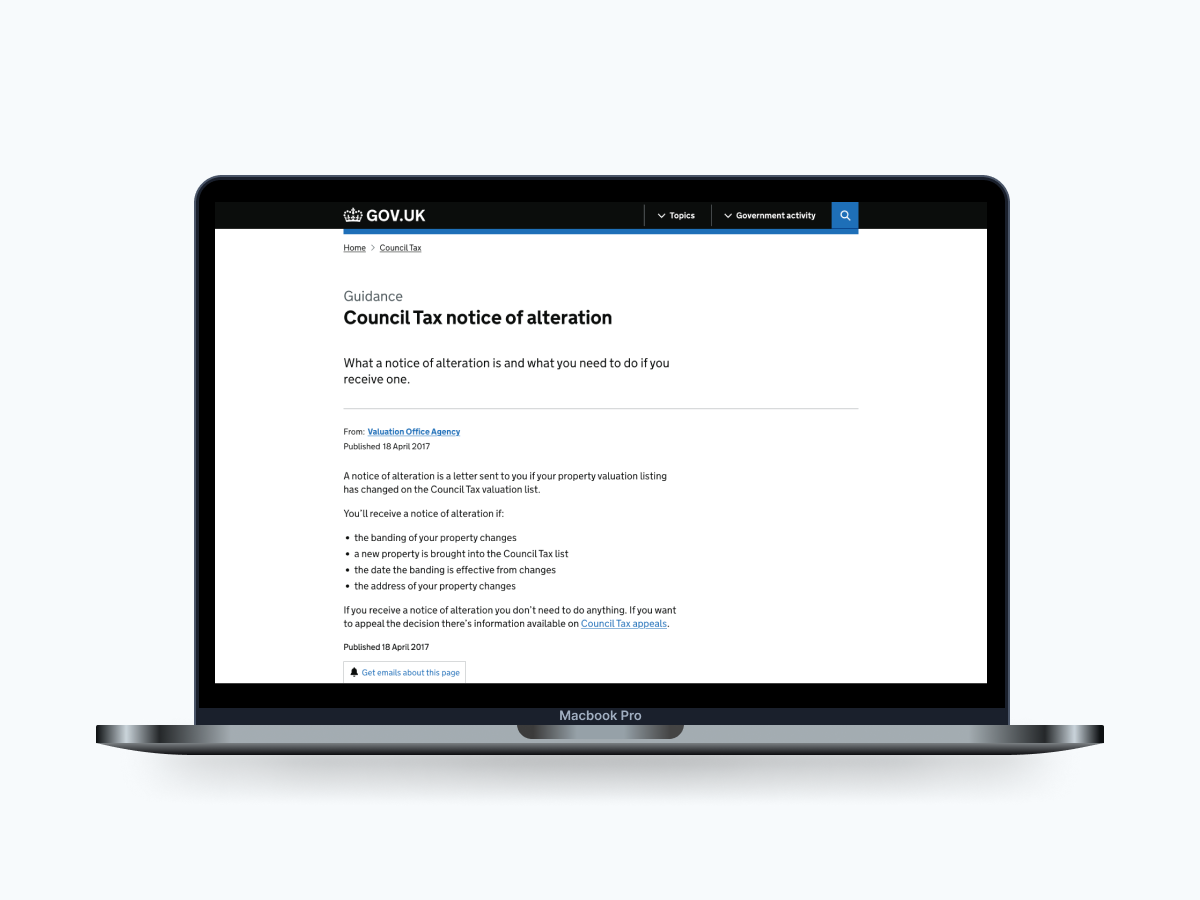

New content for Council Tax notice of alteration.

Scope

Create a new page of guidance – heading, summary, body copy.

Role

Writer

Stakeholders

Council Tax online product owner, Council Tax subject matter expert.

Goal

Produce clear, concise copy that explains what a notice of alteration is, when you’d receive one and what to do if you receive one.

Challenges

Making sure the content answers the users’ questions, steering them away from contacting us (self serve).

Basic process

- Get understanding of key points from SME

- Write first draft

- Get draft checked for factual accuracy by SME

- Have work checked by other Content Designers

- Publish

- After 3 months checked by other Content Designers from other departments and GDS

- Update

Results

There was a drop in the number of customers contacting the VOA about Council Tax notices of alteration.

Detail

While working on a new digital service I received statistics on the number of contact we’re getting from the public and what they’re asking about. I categorised the types of contact (such as Council Tax, business rates, etc) and then grouped these into topics (such as ‘paying my bill’, ‘changes to my property’, etc). I tallied up the amount of contact we’re getting for each group and ordered them into the top 10 for each business category.

For Council Tax, one of the top 10 was people not knowing what a ‘notice of alteration’ is, means or what to do with it. I then looked over our record of pages on GOV.UK and did my own searches for information – there was nothing. This showed a major gap in the information we’re providing and there’s clearly a user need for it.

Next, I contacted the product owner for Council Tax online. I explained the contact results and how information was missing from GOV.UK. The product owner then provided a subject matter expert (SME) and I asked them to provide me a bullet list of:

- what a notice of alteration is

- why someone would receive one

- what they’d need to do if they received one

With this basic outline of the information I could write the content in a clear and simple way. I sent my first draft to the SME and product owner so they could check it for factual accuracy. The final sentences of the content explain to the reader they can “appeal the decision” and links to a page called “Council Tax appeals”. They argued this isn’t the correct terminology and it’s actually a ‘Council Tax challenge’.

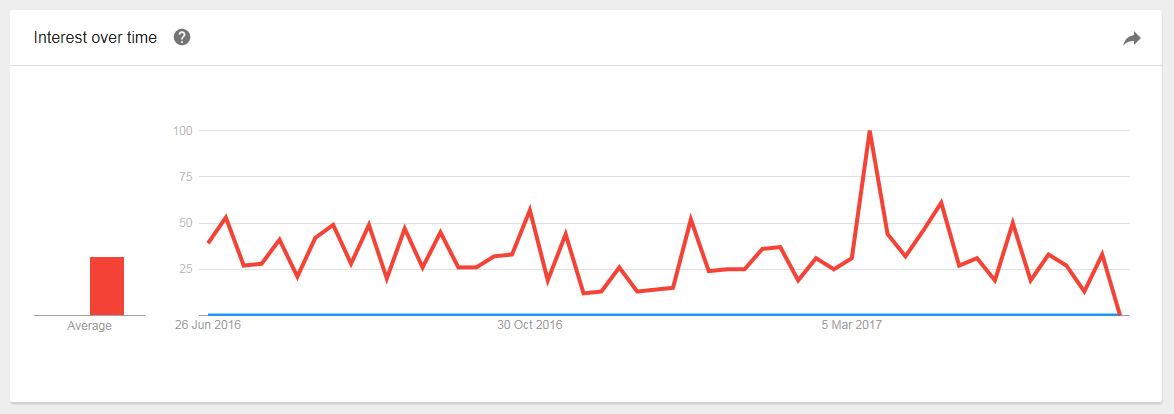

It’s generally agreed that Google is the ‘homepage’ of GOV.UK. Users search Google and access GOV.UK through the results they get. Using Google Trends to provide statistical evidence, I compared ‘Council Tax challenge’ and ‘Council Tax appeal’ in the UK over the last 12 months.

This showed that ‘appeal’ is used far more than ‘challenge’. I provided this information to the product owner and the SME to back up my word choice. After seeing this they agreed with my decision and were happy for me to go ahead with the content I’d written.

Before publishing to GOV.UK I then took this page to a ‘content crit’ with the other Content Designers in the VOA. We then read through it and they gave me feedback and suggestions. Having this fresh pair of eyes was really helpful and helped inform a better way of structuring the content. I then published the content.

After 3 months I took my content to a content crit with Government Digital Services (GDS). This crit had a number of people from different government departments and a GDS representative. Holding the content crit with a larger audience, with different views and experiences, helped inform the way it’s written even further. I managed to cut the number of words down into more concise sentences that directly told the audience the information they needed to know.

After this I contacted the product owner and SME to get one last check that it was still factually accurate. They were happy with the content and I updated it on GOV.UK, publishing to live.